When a hospital runs out of saline solution, it’s not just an inconvenience-it’s a crisis. Patients on IVs go without hydration. Surgery gets postponed. Critical care units scramble. This isn’t science fiction. In 2025, injectable medication shortages are still crippling hospitals across the U.S., and pharmacy teams are bearing the heaviest burden.

Why Hospital Pharmacies Are Ground Zero

Hospital pharmacies don’t just fill prescriptions. They manage life-or-death medications that can’t be swapped out like a bottle of pills. Injectable drugs-like chemotherapy agents, anesthetics, and IV antibiotics-are the backbone of emergency care, surgery, and intensive treatment. But here’s the problem: 60% of all drug shortages in 2025 involve sterile injectables. That’s not a coincidence. These drugs are harder to make, harder to test, and harder to replace.While a community pharmacy might run low on a blood pressure pill and switch brands without issue, hospitals can’t just substitute a different IV drug. Even small differences in concentration or additives can change how a drug works-or make it unsafe. A patient getting chemotherapy for leukemia can’t just take a different version of cisplatin if it’s not bioequivalent. The stakes are too high.

That’s why hospital pharmacies are hit harder than any other setting. About 35-40% of their essential inventory is affected by shortages, compared to just 15-20% in retail pharmacies. And for academic medical centers treating complex cases, the impact is 2.3 times worse. One nurse manager in Massachusetts reported postponing 37 surgeries in just three months because they ran out of anesthetics. That’s not a one-off. It’s happening nationwide.

The Root Causes: It’s Not Just Bad Luck

You might think shortages happen because of bad weather or supply chain snarls. But the real reasons are deeper-and they’ve been building for years.First, low profit margins. Most sterile injectables are generic drugs. Manufacturers make only 3-5% profit on them. That’s not enough to invest in modern equipment, backup systems, or quality controls. When a machine breaks or a batch fails, it’s cheaper to shut down than fix it.

Second, manufacturing is concentrated. Around 80% of the raw ingredients for these drugs come from just two countries: China and India. One tornado in North Carolina in 2023 knocked out 15 critical medications. A single FDA inspection in India in early 2024 shut down cisplatin production for months. These aren’t rare events-they’re predictable.

Third, quality failures drive 55% of shortages. The FDA doesn’t have the power to force companies to fix problems before they cause shortages. Even when a company reports a potential shortage, only 14% of those reports lead to timely fixes. The system is reactive, not preventive.

And then there’s consolidation. Three companies now control 65% of the market for basic IV fluids like sodium chloride and potassium chloride. One plant goes down? Millions of patients are affected. There’s no backup. No redundancy. Just a fragile, single-threaded supply chain.

Who Gets Hurt the Most?

It’s not just hospitals. It’s the people inside them.The Department of Health and Human Services estimates each drug shortage affects about half a million people. More than 30% of those are seniors between 65 and 85. These are patients with heart failure, cancer, or sepsis-people who can’t wait for a drug to come back in stock.

Some of the most affected drugs are the ones you’d expect to always be available:

- Anesthetics: 87% shortage rate

- Chemotherapeutics: 76% shortage rate

- Cardiovascular injectables: 68% shortage rate

When anesthetics run out, surgeries get canceled. When chemo drugs disappear, treatment delays can mean the difference between remission and progression. When IV antibiotics aren’t available, infections spread. And when saline is gone? Nurses have to switch patients to oral hydration-even when it’s less effective, even when it’s not ideal. One pharmacist on Reddit wrote: “Running out of normal saline for three weeks straight forced us to get creative with oral rehydration for post-op patients-never thought I’d see the day.”

What Hospital Pharmacies Are Doing to Cope

They’re not sitting still. Hospital pharmacists are working 11.7 hours a week just managing shortages-tracking inventory, calling suppliers, finding alternatives, training staff, and documenting everything.Some hospitals have formed shortage management committees. But only 32% of them feel properly staffed or funded. Most are run by pharmacists who are already overworked.

Common strategies include:

- Consolidating stock in one central location to avoid waste

- Creating approved lists of therapeutic alternatives

- Building relationships with smaller, niche suppliers

- Using tiered allocation systems-prioritizing the sickest patients first

These steps help. One hospital system reduced clinical disruption by 15-20% after implementing a formal shortage protocol. But they don’t fix the problem. They just manage the fallout.

And the learning curve is steep. A University of Michigan study found new pharmacy directors take an average of 6.2 months to become proficient in shortage management. Meanwhile, 31% of hospitals still rely on informal, ad-hoc methods-raising the risk of medication errors.

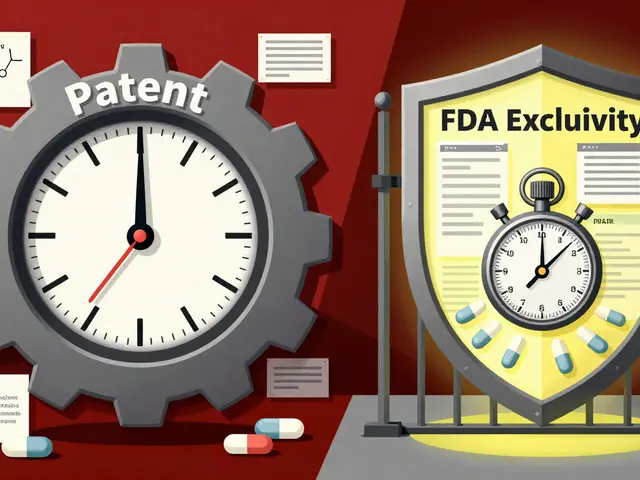

Why Policy Hasn’t Fixed This

You’d think the government would step in. After all, this is a national health crisis.The FDA’s Drug Supply Chain Security Act requires better tracking. The Consolidated Appropriations Act of 2023 forced earlier shortage notifications. But the results? Only a 7% reduction in shortage duration, according to the Government Accountability Office.

The Biden administration pledged $1.2 billion in 2024 to boost domestic manufacturing. That sounds promising. But experts say it’ll take 3-5 years to see any real impact. By then, another 200-250 drugs could be in shortage.

The FDA’s 2025 Strategic Plan for Drug Shortage Prevention includes incentives for better quality-but no penalties for failure. The American Medical Association called it “insufficient to address the systemic nature of the problem.”

And here’s the kicker: only 12% of sterile injectable manufacturers have adopted modern production methods like continuous manufacturing, which could make supply chains more resilient. Why? Because it costs money. And with profit margins this thin, no one wants to risk it.

The Future: No Easy Answers

As of July 2025, there were 226 active drug shortages-down from 270 earlier in the year. That sounds like progress. But here’s the truth: 89% of the shortages in 2024 were carryovers from 2023. Most have lasted for years.The numbers might dip slightly, but the underlying problems haven’t changed. Geopolitical instability. Climate-related disruptions. Economic pressure on generic manufacturers. Lack of investment in quality. A supply chain built on fragile, single-source production.

Hospital pharmacies will keep adapting. Pharmacists will keep working overtime. Nurses will keep finding workarounds. But without real reform-without forcing manufacturers to invest in resilience, without diversifying supply chains, without creating real financial incentives for quality-this won’t get better.

It’s not about running out of a single drug. It’s about a system that treats life-saving medications like commodities instead of necessities. And until that changes, hospitals will keep paying the price.

8 Comments

Let’s be real: this isn’t a supply chain issue-it’s a market failure. Generic injectables are treated like commodities, but they’re not. They’re biological infrastructure. The profit margin on saline is 3.5%? That’s not a business model-it’s a death sentence for vulnerable patients. We’ve outsourced production to two countries with zero redundancy, and now we’re surprised when a tornado in North Carolina collapses 15 drugs? We need mandatory dual-sourcing, federal price floors for critical generics, and penalties for quality lapses-not just “strategic plans.”

So let me get this straight-hospitals are canceling surgeries because a company in India got shut down for failing an FDA inspection, and the FDA’s solution is to ask nicely? No fines. No deadlines. Just a 7% reduction in duration after a decade of this? This isn’t negligence-it’s institutionalized cruelty. And the worst part? The same people who run these companies sit on advisory boards telling us we need ‘more innovation.’ Innovation? We need enforcement.

87% shortage rate for anesthetics? That’s not a statistic-it’s a crime. But let’s not pretend hospitals are innocent here. Most don’t maintain buffer stock because ‘just-in-time inventory’ looks good on a CFO’s dashboard. They’re optimizing for cost, not survival. And now they’re crying when the system they engineered collapses? Don’t act surprised when you starve the machine and it breaks.

It is of paramount importance to recognize that the systemic deficiencies in the pharmaceutical supply chain are not attributable to isolated incidents, but rather to a profound and multifaceted disintegration of regulatory, economic, and logistical frameworks. The confluence of geopolitical instability, capital misallocation, and the absence of mandatory quality assurance protocols has engendered a state of chronic vulnerability that transcends mere operational inefficiency. It is, in essence, a civilizational failure of prioritization.

I know it feels hopeless-but we’re not powerless. I’ve seen pharmacies in rural Ohio pull together, share stock across county lines, train nurses to recognize early warning signs of shortages, and even partner with local med schools to track inventory in real time. It’s messy. It’s exhausting. But it’s working. Change doesn’t come from Congress-it comes from people in scrubs and lab coats refusing to give up. Keep going. We’ve got this.

One must interrogate the underlying moral calculus of this crisis. The fact that manufacturers are permitted to operate with profit margins below 5% on life-sustaining pharmaceuticals constitutes a de facto subsidy of negligence. The absence of punitive measures for repeated quality failures is not merely regulatory inaction-it is a violation of the social contract. The FDA’s ‘strategic plan’ is a euphemism for surrender. Until manufacturers are held financially and criminally liable for preventable shortages, no amount of ‘optimism’ or ‘community coordination’ will mitigate the systemic rot.

Interesting that the article mentions the University of Michigan’s 6.2-month learning curve for new pharmacy directors-but doesn’t mention that many hospitals still don’t have dedicated shortage managers at all. The fact that 31% rely on ad-hoc methods isn’t an oversight-it’s a policy choice. We’ve underfunded pharmacy leadership for decades and now we’re surprised when things fall apart? The solution isn’t more workarounds. It’s structural investment.

Actually, the real issue is that we’re treating injectables like they’re irreplaceable. Why not invest in subcutaneous alternatives? Or oral bioequivalents? The entire system is stuck in 1980s thinking. If we’d embraced new delivery systems decades ago, we wouldn’t be this fragile. This isn’t a shortage crisis-it’s an innovation crisis. And yes, I’m talking to you, hospital administrators clinging to IVs like they’re sacred relics.