When you’re on multiple medications, you might assume getting them as a single pill - a combination drug - would be cheaper and simpler. But that’s not always true. Insurance plans often treat generic combination drugs very differently from buying the same ingredients as separate generics. And the difference in your out-of-pocket cost can be $40 a month or more.

Why Insurance Plans Treat Combination Drugs Differently

Insurance companies don’t just look at what’s in the pill. They look at how it’s priced, how many manufacturers make it, and how easy it is to control costs. A combination drug - like a pill with both amlodipine and lisinopril for high blood pressure - might sound like a bargain. But if only one company makes the generic version, the price doesn’t drop like it should. That’s called a single-source generic. Without competition, the manufacturer can charge more, and insurers notice. Meanwhile, if you buy the same two drugs as separate generics, you’re likely paying $5 to $10 each. That’s because dozens of companies make those individual drugs. The market drives prices down. So even though the combination pill has the same active ingredients, your plan might cover the two separate pills at a lower cost than the combo.How Medicare Part D Handles This

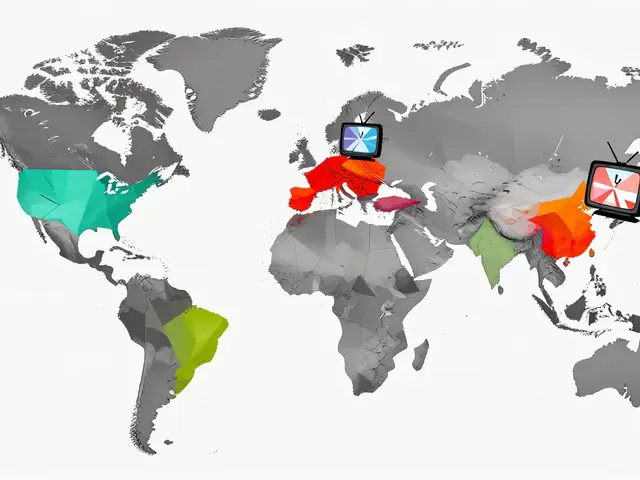

Medicare Part D plans cover 84% of prescriptions with generic-only options - up from 69% in 2012. That means most plans won’t pay for brand-name drugs if a generic is available. But here’s the catch: they don’t always cover combination generics the same way they cover individual ones. Medicare uses a tier system:- Tier 1: Preferred generics - usually $0 to $5 copay

- Tier 2: Non-preferred generics - $10 to $15

- Tier 3: Preferred brand-name drugs - $40+

- Tier 4: Non-preferred brands and specialty drugs - $100+

Real-Life Cost Examples

Take a common blood pressure combo: amlodipine/valsartan. The brand-name version used to cost $120 a month. Now, the generic combo costs $45. But if you buy amlodipine and valsartan as separate generics? Each is $8. Total: $16. That’s $29 cheaper per month - and your plan still covers both. Another example: metformin/glipizide for diabetes. The combo pill might cost $35. The two separate generics? $5 and $7. Total: $12. That’s a $23 monthly difference. And that’s not rare. A 2023 review found that in 38% of cases where both options existed, buying the individual generics was cheaper than the combination. But here’s the flip side: sometimes the combo is cheaper. When a combination drug went generic for a patient with high cholesterol (simvastatin/ezetimibe), their monthly cost dropped from $47 to $7. Why? Because the combo was the first to go generic - and the individual versions hadn’t yet been priced down by competition.

Why Your Doctor Might Not Know

Doctors are trained to prescribe for effectiveness and safety, not pharmacy formularies. They might write a prescription for a combination drug thinking it’s simpler for you. But if your plan doesn’t cover it well, you could end up paying more - or even having to go back to your doctor to split the prescription. That’s why it’s smart to ask: “Is there a cheaper way to get these same medications?” You can also ask your pharmacist to run a cost comparison. Most pharmacies have tools that show you the price difference between combo pills and separate generics.What to Do If Your Plan Won’t Cover the Combo

If your plan covers the individual generics but not the combo - or charges way more for the combo - you have options:- Ask your doctor to write two prescriptions. This is legal and common. Many patients do this to save money.

- Request a coverage determination. If your doctor says the combo is medically necessary, your plan must review it. Standard reviews take 72 hours. Expedited reviews (if your health is at risk) take 24 hours.

- Check if you qualify for manufacturer assistance. After a federal court ruling in September 2023, copay assistance programs can now count toward your out-of-pocket maximum. That means if you’re using a brand-name combo, you might get help lowering your costs.

The Bigger Picture: Why This System Exists

Insurance plans favor generics because they save money. Generic drugs cost 80-85% less than brand names. In some cases, when six or more companies make the same generic, prices drop by 95%. That’s why 90% of U.S. prescriptions are filled with generics - even though they make up only 25% of total drug spending. But combination drugs are trickier. They represent about 15% of all prescriptions but 28% of top-selling drugs. As more of them go generic - thanks to FDA’s GDUFA III program accelerating approvals - this gap will shrink. By 2028, generic drug use is expected to rise to 93% of all prescriptions. The problem now is timing. When a combo goes generic, it often takes months - sometimes years - for the individual components to catch up in price. During that window, patients can get stuck paying more for the combo than they should.

What’s Changing in 2025

Starting January 1, 2024, Medicare Part D eliminated deductibles and capped out-of-pocket spending at $2,000 a year. That helps everyone - but it doesn’t change how formularies are structured. You still need to know which drugs are on which tier. Also, the ban on copay accumulator programs means manufacturer coupons now count toward your annual limit. That’s a win for people who need expensive combos without generic alternatives. But if you’re using separate generics? You probably don’t need coupons at all.What You Can Do Today

1. Know your plan’s tier list. Log into your Medicare or private insurer’s website. Search your medications. See what tier they’re on. 2. Compare prices. Use the Medicare Plan Finder tool or GoodRx. Enter the combo and the two separate drugs. See which is cheaper. 3. Ask your pharmacist. They can run a cost comparison in seconds. Many will do it for free. 4. Don’t assume the combo is better. If you’re taking two pills a day instead of one, that’s not a burden - it’s a savings. 5. Speak up. If you’re paying more for a combo than you should, file a coverage request. Your doctor’s note can make a difference.Bottom Line

Generic combination drugs aren’t automatically cheaper. Sometimes they’re more expensive than buying the same ingredients separately. Insurance plans structure coverage around cost, competition, and convenience - not always what’s best for you. The key is to check the math before you fill your prescription. A $30 difference per month adds up to $360 a year. That’s a new pair of shoes, a weekend getaway, or a month’s worth of groceries. Don’t let your plan’s formulary rules cost you more than you have to.Can I ask my doctor to prescribe separate generics instead of a combination pill?

Yes, absolutely. Many patients do this to save money. Your doctor can write two separate prescriptions for the individual generic drugs. This is common, legal, and often more cost-effective. Just make sure your pharmacist knows you want to fill them as two separate medications.

Why is my combination drug more expensive than the two separate generics?

It’s usually because the combination drug has fewer manufacturers - sometimes only one. That’s called a single-source generic. Without competition, the price doesn’t drop like it does for generics made by 10+ companies. Meanwhile, the individual drugs have many makers, so their prices are driven way down. Your insurance plan reflects that difference.

Does Medicare cover generic combination drugs?

Yes, most Medicare Part D plans cover generic combination drugs - but not always at the lowest cost. They’re often placed on Tier 2 or higher, while individual generics are on Tier 1. Always check your plan’s formulary or use the Medicare Plan Finder to compare costs before choosing.

What if my plan won’t cover the combination drug at all?

You can request a coverage determination. This is a formal appeal asking your plan to cover the drug. Your doctor must provide a letter explaining why the combination is medically necessary. Standard reviews take 72 hours; expedited reviews (for urgent cases) take 24 hours. Many approvals happen this way.

Are generic combination drugs as safe as brand-name ones?

Yes. The FDA requires generic drugs - including combinations - to be bioequivalent to brand-name versions. That means they work the same way in your body, with the same strength, safety, and dosage. The only differences might be inactive ingredients like fillers, which rarely affect how the drug works.

How do I find out which tier my medication is on?

Log into your insurance plan’s website and look for the formulary or drug list. You can also call customer service or ask your pharmacist. Medicare Part D plans are required to make this information easy to find. If it’s hard to find, that’s a red flag - consider switching plans during open enrollment.

11 Comments

Just split your pills. Two pills a day is fine. Saves me $30 monthly. No drama.

It's not about pills. It's about control. The system wants you dependent on the combo because it keeps the money flowing upward. We're not patients. We're data points with copays.

Why are Indians even talking about this? In America we just pay cash and move on. This whole insurance mess is why we need to stop letting bureaucrats run healthcare. Get off the grid. Buy generics at Walmart. Done.

Oh my god. I just found out my blood pressure combo costs $45... but the two separate pills? $8 each. That's $16. I've been paying $30 extra every month for TWO YEARS. I feel like I've been robbed. My pharmacist never told me. My doctor never asked. The system is designed to make you suffer silently. I'm crying. I'm so angry. I need a new life.

This is actually really helpful. I never thought to check the individual prices. I always assumed the combo was the smarter choice. Turns out, I was just being lazy. I'll ask my pharmacist next time. Thanks for the clarity.

The structural inefficiencies inherent in pharmaceutical formulary design reflect a broader epistemological failure in neoliberal healthcare policy. The commodification of therapeutic regimens, particularly in the context of single-source generics, demonstrates a profound misalignment between clinical utility and economic incentive structures. One must question whether patient autonomy is truly preserved under such a regime.

Wait… you think this is just about money? NO. This is a BIG PHARMA plot. They pay off the FDA, the PBMs, the doctors… they make the combo pills expensive so you’ll stay hooked. They’re poisoning the water supply too. You think your insulin is safe? It’s not. They’re tracking you through your pills. The government knows. They’re all in on it.

Why do people even bother with insurance? Just buy the generics on GoodRx. Cash price is always cheaper. Stop letting corporations play you. This whole system is rigged and you're just giving them your money.

But isn't it kind of beautiful? We're so obsessed with saving $30 a month that we forget the real cost is the stress of juggling pills, pharmacies, and paperwork. Maybe the combo isn't about price. Maybe it's about peace.

Love this. I'm from Nigeria and we don't have insurance here but I still know this. In Lagos, people split pills all the time. Simple. Smart. Real. America needs to catch up.

You people don't understand. In Nigeria, we get generics for free from NGOs. We don't have formularies. We don't have tiers. We have survival. You're arguing over $30 a month while we're choosing between food and medicine. This is a luxury problem. You're all so privileged.